The global memory market is entering a period of sustained volatility, and for OEMs and electronics manufacturers this is no longer a distant or abstract concern. It is a real planning challenge that needs to be addressed early.

What is driving volatility in the memory market?

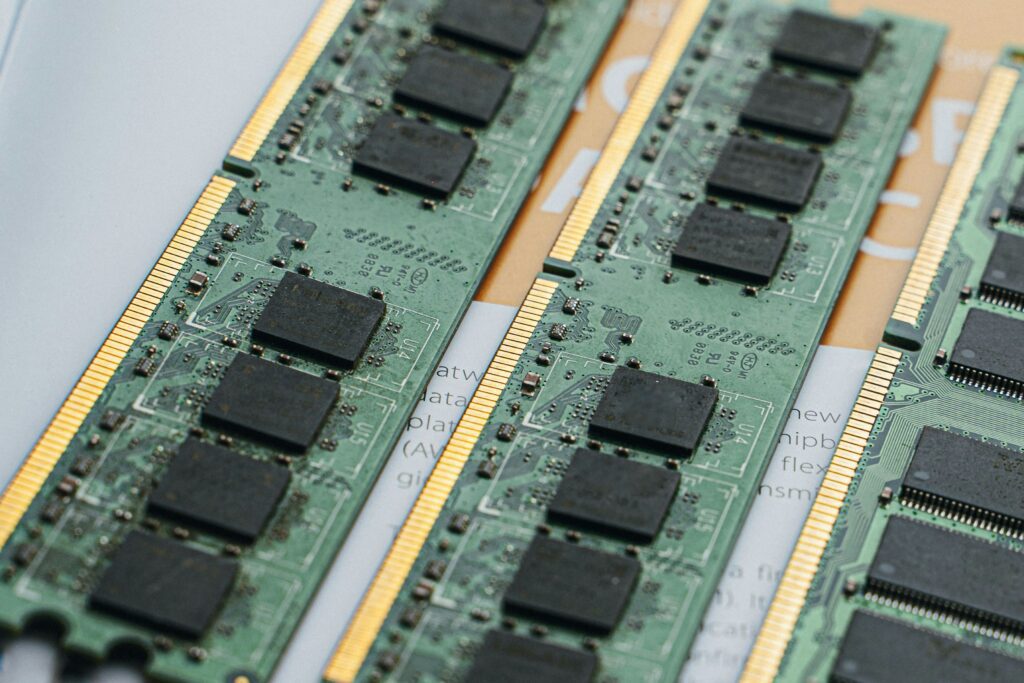

Pricing for both DRAM and NAND flash memory has been trending upward for some time, and this pressure is expected to continue. A major factor is the rapid growth of large-scale data centre infrastructure and AI-driven applications, which are consuming an increasing share of global memory output. These sectors demand high volumes and often take priority, reducing the capacity available to support the wider electronics market.

At the same time, memory manufacturers are actively rationalising their product portfolios. Several commonly used legacy memory types are being phased down or discontinued as suppliers focus on newer technologies. For manufacturers still designing with or relying on these parts, this can lead to reduced availability, longer lead times and higher costs as supply tightens.

Another important factor is the pace of modern product development. Shorter design cycles and faster time-to-market expectations mean memory demand can appear with little warning. When demand spikes unexpectedly, it places additional strain on an already constrained supply chain, increasing the likelihood of allocation limits or sudden price changes.

What does this mean in practical terms?

For electronics manufacturers, the risks surrounding memory are becoming increasingly clear:

- Pricing is more volatile and harder to forecast

- Availability of certain memory devices is less predictable

- Spot-market purchasing is becoming more common and more expensive

- Build schedules and customer commitments are more exposed to disruption

These challenges do not always appear as outright shortages; they show up as delays, partial allocations, rising costs or the need to replan builds at short notice. For programmes with tight schedules or fixed commercial commitments, this can quickly become problematic.

Why planning ahead makes a real difference

The customers best positioned to manage this environment are those already planning ahead. Early commitment allows memory and other critical components to be secured before further price movement and before capacity tightens further. It also provides greater certainty around allocation, reducing the risk of last-minute changes to production plans.

Forward purchasing can also support more accurate cost forecasting, helping avoid unexpected increases that can erode margins or force uncomfortable conversations with end customers.

How Active-PCB can support you

At Active-PCB Solutions, we work closely with customers to help mitigate memory-related risk. We can purchase memory and other critical components in advance, aligned to forecast demand and production schedules. Where required, we are able to securely store customer-owned material, allowing builds to proceed as planned without exposure to future market volatility.

This approach gives customers greater control over cost, availability and timing, while reducing reliance on short-notice purchasing and spot-market pricing.

Early planning is no longer just about cost control. It is about continuity, predictability and reducing risk in an increasingly constrained electronics supply chain.

If you have builds planned for 2026, now is the right time to review your memory requirements. Contact the team at Active-PCB Solutions to disucss your advance purchasing options.